As gridlock in Congress continues over the end of expanded health insurance subsidies, thousands of Vermonters will begin to confront an impossible choice about what to do in 2026: pay more or go without health insurance.

When the window to buy 2026 plans on Vermont Health Connect opens on Saturday, nearly 30,000 Vermonters will face what for many is an impossible choice: pay double or triple what they have been paying for their health insurance or go without.

Meanwhile, the federal government remains shuttered and Congress is gridlocked over extending the current subsidies that have made this insurance more accessible.

For Allison Mindel and her family, there is no real choice.

Since February, her 17-year-old son, Lei DeGroot, has been in intensive treatment at University of Vermont Medical Center for acute myeloid leukemia.

AML is a brutal cancer. It requires rounds of intense chemotherapy. It starts in the bone marrow and moves to the blood, which gives the cancerous cells a highway to spread throughout the body.

Over the past seven months, Lei has spent a total of 174 days in the hospital. Mindel and her husband Matthew DeGroot split up the weeks, dividing time between their home in Worcester and UVM Medical Center’s inpatient rooms. In total, Lei has gone through five rounds of treatment, cycling through one week of the system-blasting therapy, followed by three to four weeks of recovery, his immune system made raw and vulnerable to infection.

Two weeks ago, Lei was officially declared cancer-free. Last week, his central line for treatment was removed. The next day, he was able to go back to school in person.

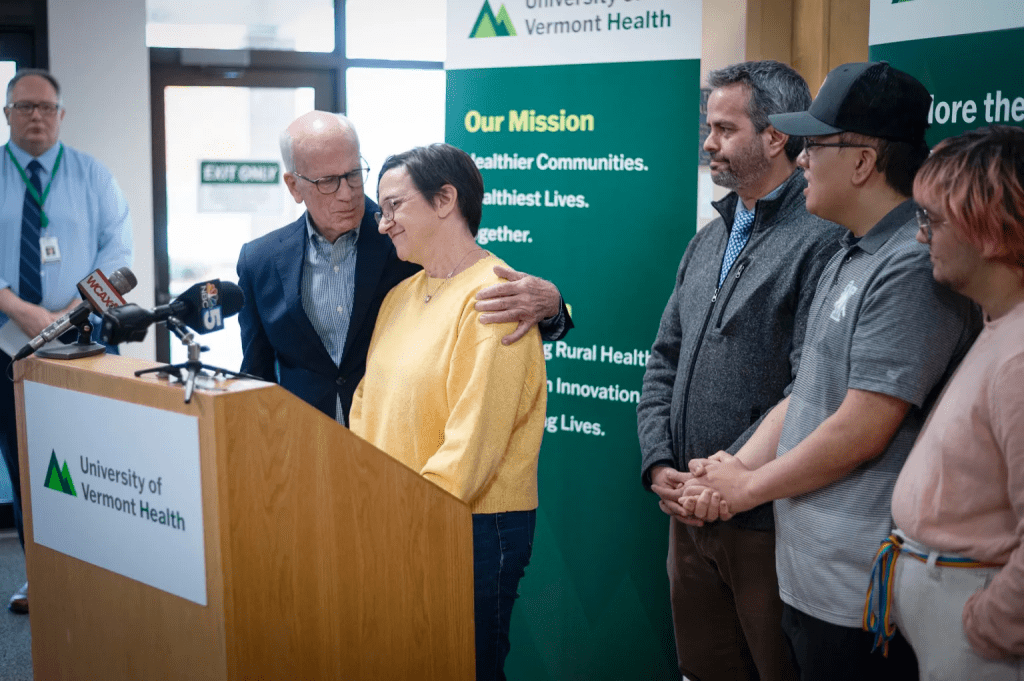

On Friday, Mindel, her husband, and two of their children joined Sen. Peter Welch, Vermont hospital leaders and other families hit by the high cost of care in a press conference to advocate for the extension of the federal subsidies.

Mindel estimates that her son’s care cost between $1.5 million and $2 million. With the insurance her family of five has bought from Vermont Health Connect, she estimates they will end up paying $19,192 for the year: the $1,066 monthly premium for their top-tier MVP Gold plan, plus the $6,400 maximum deductible.

“When you’re [in the hospital] you see all the other people with all the other stories, and you realize, we are so grateful that we didn’t have to worry about our insurance coverage, and that it covered things.” Mindel told VTDigger. “There were so many other kinds of nightmare scenarios to worry about.”

Now, she is confronting a new nightmare as she weighs the costs of next year’s insurance. This coming year, without the enhanced subsidies for marketplace health insurance, the premium for the same MVP Gold plan will cost $3,386.47 a month — an annual total over $40,600.

Mindell runs her own consulting business, and her husband had worked for a small lobbying firm that didn’t provide its employees with insurance before he was laid off in July. He’s seeking a new job, but they are not optimistic he will find one that offers insurance for a full family anytime soon.

They can’t imagine going without health insurance. Her son will continue to need monthly blood tests and followup appointments, bone marrow biopsies, and expensive prescription drugs to manage and monitor his health.

“The care and the expenses don’t end,” Mindel said.

Expanding affordability

The tax credits that made Mindel’s insurance — and the care it paid for it—affordable have only been available for a few years. They are on track to sunset soon, on Dec. 31, 2025.

The 2010 Affordable Care Act, or ACA, laid the regulatory foundation for Vermont Health Connect, as well as the special marketplaces created by other states and the federal government for people to buy commercial insurance. The law also put in place a system of tax credits that have subsidized purchasing insurance plans for households making between 138% and 400% of the federal poverty level. (Anyone below that income level is eligible for Vermont’s Medicaid insurance program).

In 2021, the American Rescue Plan expanded those tax credits, making ACA marketplace insurance plans newly affordable for millions of Americans, including thousands of Vermonters.

These “enhanced tax credits” became available to households earning more than 400% of the federal poverty line. The law capped the cost of premiums purchased by individuals and families on the marketplaces at 8.5% of a household’s income. Subsidies were also increased for many individuals already receiving credits, making health insurance premiums very low cost, or effectively free, for those households at the lowest income levels.

In 2015, soon after Vermont Health Connect opened, 22,500 people on the marketplace received tax credits, according to an analysis by the Montpelier-based research group Public Assets Institute. Today, with the enhanced credits, that number is closer to 27,000. The amount each recipient receives in credits has jumped significantly in that decade as well: in 2015 a Vermonter’s average credit was $3,300. Today, that’s $11,400 in support, the Public Assets Institute found.

Without these expanded subsidies in the future, households will experience steeper costs in two different ways. Households making more than 400% of the federal poverty line will lose the subsidies entirely, and those under that income threshold, who still receive subsidies, will see the amount of assistance shrink.

Nationally, subsidized enrollees on the marketplace are seeing an average increase in their monthly premiums of about 114%, estimates the health news outlet KFF.

In Vermont, the increase is even more stark. Because Vermont has some of the highest insurance premiums in the country, it stands out as one of the states in the country poised to lose some of the most federal assistance — nearly $65 million, a 2024 report to the legislature found. Premiums for some families could increase nearly 300%.

Vermont’s Health Care Advocate Mike Fisher outlined some examples of just what this means for families in the state during a mid-October legislative committee meeting.

He said a family of three, for instance, earning $86,000 a year — 323% above the federal poverty level, would have paid $121 with the enhanced tax credits in 2025 for a standard Gold Plan through MVP and $330 for one from Blue Cross Blue Shield VT. This coming year, those same plans will cost $291 or $856, respectively.

Or, consider Cameron Chapman, a freelance writer and editor in Hardwick.

In 2025, Chapman paid a little less than $500 a month for a Gold Plan through MVP, she told VTDigger. Next year, without the subsidies, the cost will increase to $1,135 a month for the same plan — more than she pays each month for housing.

Chapman is not planning on purchasing insurance at all next year and instead intends to put money aside each month and “keep (her) fingers crossed,” she said.

At 41, she knows it’s a gamble, but one, for now, she is going to take. She plans to stop smoking this winter, eat more vegetables and get more exercise in an effort to keep her own healthcare costs down.

Her most expensive health care year, she says, was in 2022, when she was in and out of doctors’ offices trying to get a diagnosis for an ongoing issue. After 28 visits and nearly nine months of diagnostics, she estimates her care would have cost between $18,000 and $20,000 if she needed to pay out of pocket. That’s the same amount, she calculates, as what she would need to pay in 2026, counting $13,620 a year just in monthly insurance premiums, plus the plans’ $5,000 deductible.

“I think for me, the biggest piece is not paying out money that I’m never going to see,” Chapman said. “I might as well take the money that I’ve been paying, put it into savings every month.”

‘A death spiral’

Insurers and policymakers expect that thousands of Vermonts will follow Chapman in her choice to forgo health insurance altogether.

Blue Cross Blue Shield of Vermont has estimated that 3,017 members will drop their marketplace plans, while MVP (which operates in Vermont and New York state) estimates it will lose 22,052 members with the end of the enhanced tax credits.

That kind of shift not only hurts the individuals who go without insurance, but it impacts everyone else in the insurance pool, Fisher, the state consumer advocate, explained to VTDigger. The people who remain insured are generally those who cannot do without insurance and are less willing to take the gamble— individuals like Alison Mindel and her family.

“Health insurance is about spreading risk; it’s about all of us [being] in the same boat and only by all of us being in the same boat, that those of us who have real health care needs have a fighting chance of paying for it,” Fisher said.

When fewer healthy people buy health insurance, insurers have to raise premiums to cover the costs of those remaining in the insurance pool. That’s because healthy people, generally, require less care and pay more money to the insurer than the insurer pays out for their health care. When insurers raise prices, more healthy people drop out. Policymakers literally call this a “death spiral.”

So, in addition to the loss of the expanded subsidies, people who buy their insurance on the marketplace are facing higher premiums that aim to accommodate this downward trend in enrollment. Nationwide, KFF, the health news outlet, calculates that —tax credits aside — the true cost of premiums across the country is increasing 26% in 2026.

In Vermont, for individuals and families, Blue Cross Blue Shield of VT plans will increase by 9.6%, while MVP’s will go up only 1.3%. Both increases are far less than what both insurers had initially requested from the state’s health care regulator. The difference in that increase is part of why MVP plans cost so much less than those from Blue Cross Blue Shield of Vermont, which has struggled with solvency, on Vermont Health Connect.

When people lose or forgo insurance, hospitals suffer too, Owen Foster, the chair of the Green Mountain Care Board, told lawmakers at the mid-October meeting. People will still face healthcare emergencies regardless of whether or not they have insurance. When they do, they show up in a hospital’s emergency room. When hospitals provide care to these patients, most cannot afford the entirety of an out-of-pocket bill. So, when patients they treat don’t have insurance, hospitals are more likely to not receive payment at all.

For Vermont’s already precarious hospitals, the loss of that revenue could be catastrophic. UVM Health, though a network of some of the state’s healthiest hospitals when it comes to revenue and cash reserves, could stand to lose up to $80 million in revenue with the end of these subsidies, estimated interim CEO Steve Leffler during Friday’s press conference with Sen. Welch.

“It’s a difficult cycle that we’re really hoping to avoid,” said Addie Strumolo, the deputy commissioner of the Department of Vermont Health Access, which oversees Vermont Health Connect. “But, that is a real concern when you have affordability challenges, like the ones we’re anticipating for open enrollment, or other obstacles to being able to remain in coverage.”

Enrolling in a precarious marketplace

Strumolo’s team is trying to help people navigate this steep change in affordability ahead of, and during, the open enrollment period on Vermont’s marketplace.

Open enrollment runs, as it does every year, from Nov. 1 through Jan 15. But to secure coverage that begins on Jan. 1, 2026, individuals need to buy their plans by Dec. 15.

Congress may approve a measure before the end of the year to extend the enhanced tax credits for 2026 health insurance plans. Strumolo said her department is ready to act quickly to get those credits to people who have already signed up for plans.

The federal government may also enact those measures later in 2026. If that happens, the state has the power to authorize a special enrollment period, she said.

For now, the department has a plan comparison tool up and running. The interactive webpage allows people to see what the costs of various plans will be in 2026, incorporating whatever subsidies they may still be eligible to receive.

“We think it’s really important for people to have coverage,” she said, even if that coverage is at a lower coverage tier “and so I think just knowing that there are options (is important).”

Fisher similarly encourages people to explore their options and shop around for one that fits their budgets. “It’s good for Vermont and good for Vermonters to have coverage, and I am afraid that many Vermonters are in plans they can’t afford,” he said.

“I worry that many Vermonters will be forced into an economic choice or financing choice when we really want them to be making a healthcare access choice,” he said.

Alison Mindel is going into 2026 making a healthcare choice for her family, and hoping the financial details work out somehow. Knowing that the ongoing care for her son is going to continue to be costly, she and her husband intend to keep buying the Gold MVP plan, just without the enhanced premium tax credits. It will cost more than their mortgage.

“I don’t know how we’re going to manage paying for this going forward,” she said. “But, at the same time, I didn’t know how we were going to get through the past year either.”

Story Written by Olivia Gieger, VTDigger

Story Link: On Vermont Health Connect, annual premium prices have doubled, or more