Elodie Reed / Vermont Public

As Vermont health insurers are proposing hefty 2025 rate hikes for individual and small group plan premiums, members of the business community say that high health care costs are slowing down the local economy.

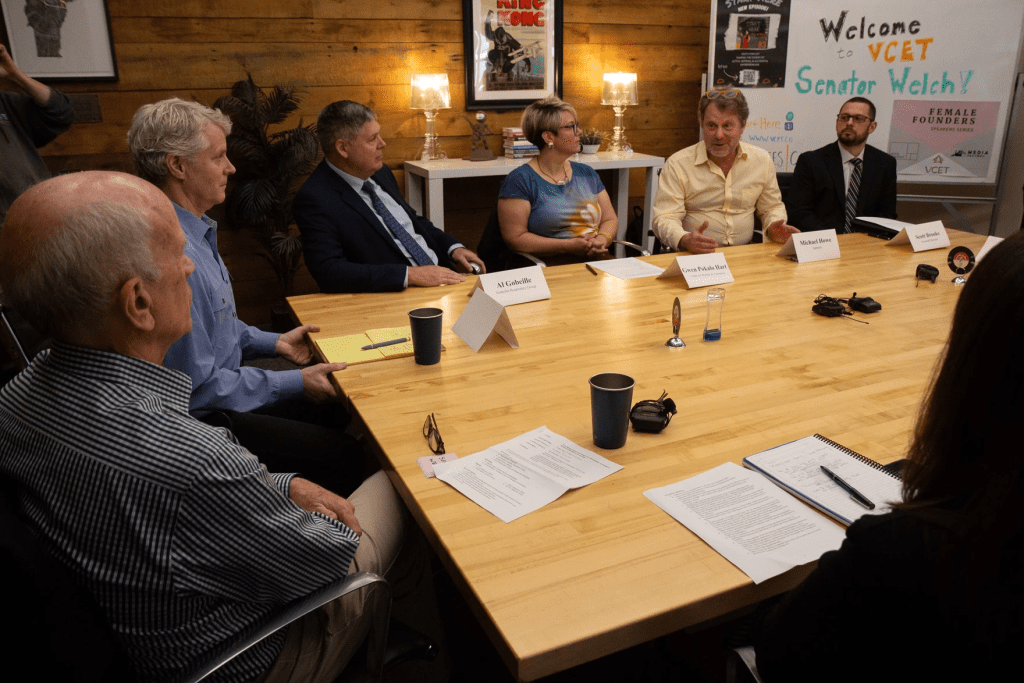

Local business owners and employers shared their experiences Friday at a roundtable discussion hosted by Sen. Peter Welch at the Vermont Center for Emerging Technologies (VCET) in Burlington.

Gwen Pokalo Hart with the nonprofit Vermont Women’s Business Center told Welch that health care costs are the No. 1 reason that women are not growing their businesses.

“When they do get sick, not only do we not have a good leave system and things like that … but so often the prescription drugs aren’t covered that they need to get well, aren’t covered by the baseline plan that they’re on,” Pokalo Hart said. “And we see people closing their business having intensive medical debt.”

Elodie Reed / Vermont Public

Health care cost is also a challenge for retaining staff. Of the 600 women entrepreneurs the Vermont Women’s Business Center serves each year, she said most employ 10 or fewer people.

“We have women who do not offer health insurance to their employees — 10 or fewer employees, it’s not cost-efficient,” Pokalo Hart said.

VCET Vice President Sam Roach-Gerber will be one of those people not insured by her employer when she transitions into a part-time position to get her own business off the ground. And she said that change in stability is terrifying.

“I think there’s many people that don’t have the support or my spouse’s insurance to go onto, to be able to take that risk,” Roach-Gerber said, adding that risk is even higher if people have young children or want to start a family.

“So I think, you know, that’s what scares me, is that it’s inhibiting so much growth, population, people starting businesses, people scaling their businesses. We see it every single day at VCET,” she said.

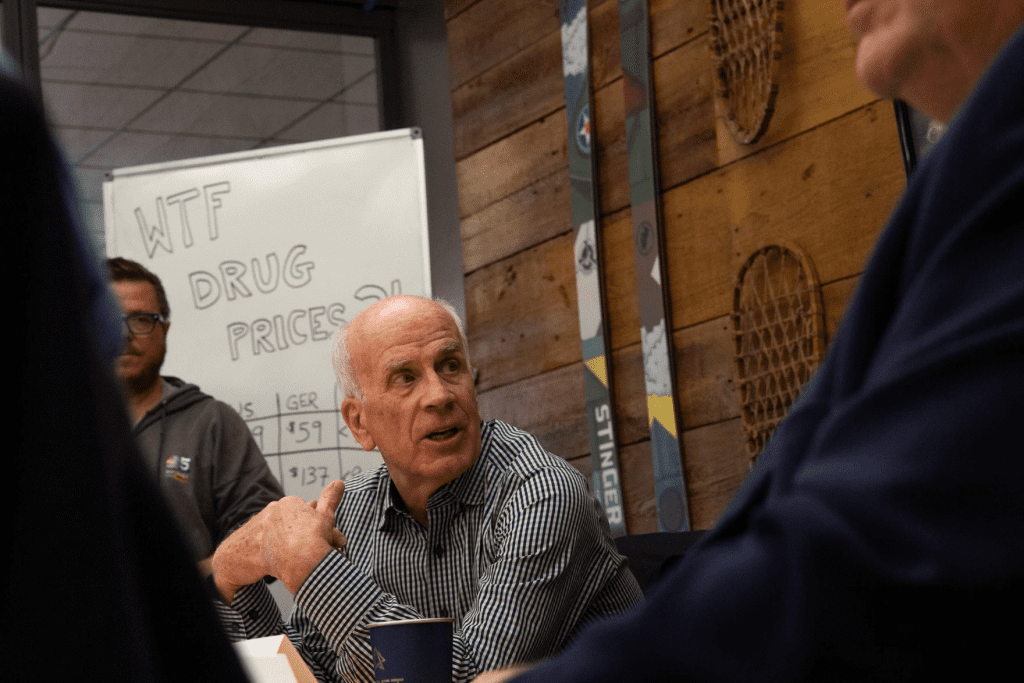

Welch told the roundtable Friday that Congress needs to change laws to protect everyday people and businesses from costs so high that no one can afford them. One step, he said, is a piece of legislation he introduced this year along with Indiana Republican Sen. Mike Braun and Minnesota Democratic Sen. Amy Klobuchar, to address the anti-competitive practices of pharmaceutical companies in the patent system.

“The patent system has been totally, totally, totally abused,” Welch said.

The bill aims to limit so-called “patent thickets” — when pharmaceutical companies file not only a parent patent for a product, but many offspring patents for the same product. Generic competitors then have to challenge all those offspring patents in court, which can be costly and time-consuming. In the meantime, drug costs go up.

“And that is completely outrageous, because we’re turning market principles upside down,” Welch said. “Market is based on competition, not protection. So you get governmental protection that are sustaining these high prices.”

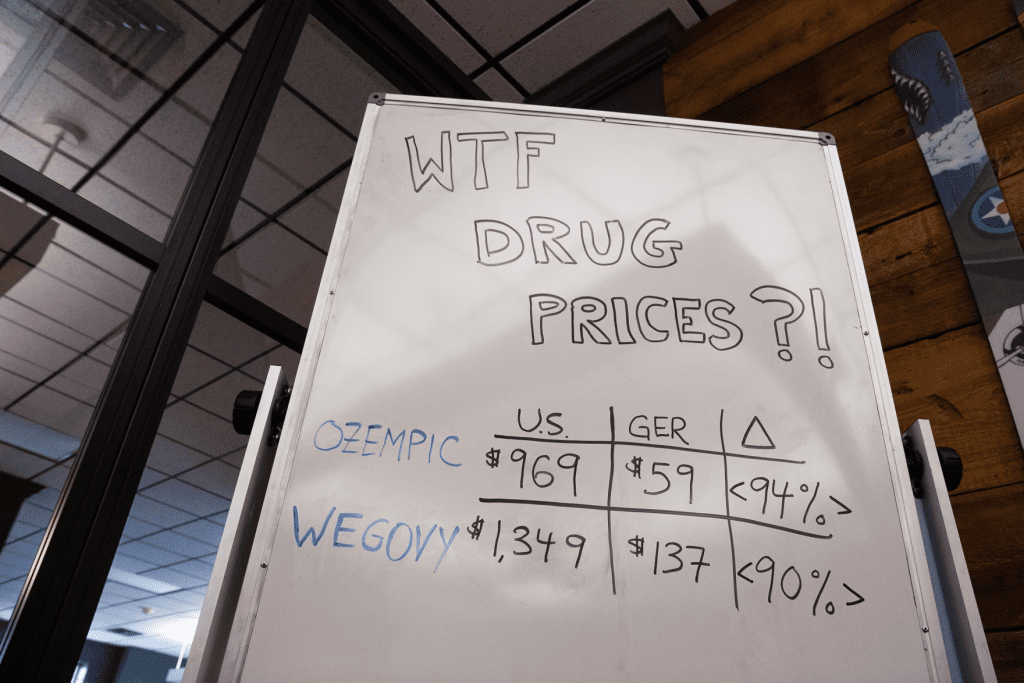

Rising prescription drug costs are among the factors cited by BlueCross BlueShield of Vermont and MVP Health Care this week as they proposed hefty increases in premium rates for 2025.

“The cost and utilization of brand and specialty drugs continue to grow precipitously, against the cost of generics,” BCBS said in a written statement.

Both insurers — the only ones available through Vermont’s state health exchange — filed their rate proposals Monday with the Green Mountain Care Board (GMCB). That’s the state body that regulates health insurance rates in Vermont.

BlueCross BlueShield is proposing average rate increases of 16.3% for individual plans and 19.1% for small group plans. In addition to the growing cost of prescription drugs — particularly GLP-1 drugs used to treat diabetes and obesity — BlueCross BlueShield says its higher proposed premium rates are due to more Vermonters accessing hospital care, and to new state policy that’s currently awaiting signature by Gov. Phil Scott.

Elodie Reed / Vermont Public

The bill, H.766, proposes to limit the occasions and waiting time that medical providers need to seek authorization before providing treatments. The Vermont Medical Society is urging Scott to approve the legislation, and he has said he’s inclined to sign the bill if the cost or savings impacts can be monitored.

The potential cost impact of the legislation was not included in the most recent rate increase proposals from MVP Health Care, which has suggested average rate jumps of 11.7% for individual plans and 9.3% for small group plans.

“Those small employers are on their own and facing, you know, year-over-year unsustainable rate increases”

Mike Fisher, Vermont Health Care Advocate

Vermont Health Care Advocate Mike Fisher represents the public before the GMCB for these health insurance rate increase proposals. And he points out that, at least for individual plans, and at least through 2025, a federal subsidy will offset any premium rate increase.

“If you are somebody who buys health insurance directly through Vermont Health Connect, and you get premium tax credits, you get a reduction in your rates due to the Affordable Care Act,” Fisher said. “These rate increases won’t impact you. All things being equal, if your income is the same, the federal subsidy will go up with the increases.”

Not so, however, for small businesses.

“Those small employers are on their own and facing, you know, year-over-year unsustainable rate increases,” Fisher said.

If approved, this would be the third year BlueCross BlueShield and MVP Health Care small group premium rates rose by double digits or nearly double digits.

As for what Vermonters can do about it, Fisher says the GMCB’s public comment process does make a difference.

“I’ve been watching the board for a long time, and they really do take into account the, you know, the public comment,” he said. “And I think particularly this year, from the small employer, the nonprofit sector, the municipalities, you know, this rate increase impacts all of them.”

The GMCB is accepting comments through mid-July on both BlueCross BlueShield and MVP Health Care’s premium rate increase proposals.

Story Written by Elodie Reed, Vermont Public