Republicans block legislation to fund Affordable Care Act premium tax credits until 2028, extend Open Enrollment until May 2026

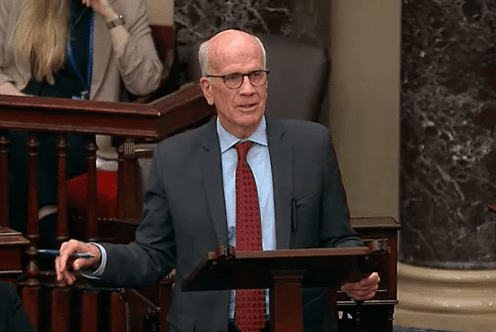

WASHINGTON, D.C. – U.S. Senator Peter Welch (D-Vt.), a member of the Senate Finance Committee, today urged the Senate to pass his bill that would extend funding for Affordable Care Act (ACA) premium tax credits by three years and extend nationwide Open Enrollment. In his remarks, Senator Welch highlighted how uninsured rates in states like Tennessee, Alabama, and North Carolina will skyrocket if Republicans fail to help Democrats extend ACA premium tax credits.

The bill, which would fund ACA premium tax credits until 2028 and extend the current Open Enrollment season to May 1, 2026, was blocked by Senate Republicans.

“I would love to get the government open, and I’d love to be able to let folks know that the health care they had in 2025—they’ll be able to have in 2026. I’d like the President to do what Presidents do—and that’s get the parties together in the room and negotiate an outcome that works for all of us,” said Senator Welch. “We have real work to do on the cost side of health care. We really all have to take that on. But the approach to dealing with the high cost of health care can’t be taking people’s health care away. It has to be making the health care they have more affordable.”

“There is an urgency to the moment, because the Open Enrollment now, in November, is here, and families have to make decisions. And this body is literally the only institution in the United States of America that has the ability; that has the authority; that has the power to provide a remedy to the families we all care about. So, that’s my plea to my Republican colleagues.”

Watch Senator Welch’s full remarks below:

Read a key excerpt from Senator Welch’s remarks:

“You know, President Trump…he’s got enormous authority, and he’s got enormous influence on the Republicans in the House and in the Senate. And it would be so good if he would come and sit down and figure out how to address this problem. The simplest way to do it is to extend the tax credits, and then all of us acknowledge that we have to address the cost of health care,” said Senator Welch. “I know in talking to many of my Republican colleagues, you’re focused on costs. Totally fair. But the answer to dealing with the cost of health care is not to take away insurance. People still get sick.”

“I do believe the one thing we cannot do in good conscience is allow these premium tax credits to expire when what that means is that the folks we care about—who have no control themselves over what the cost of health care is, they’re just on the receiving end—that we’ve got to extend those. That can bring us time to start addressing some of the concerns that my colleagues have about the cost of health care.”

•••

Over 24 million Americans rely on the ACA’s tax credits to afford health care. In Vermont, nearly 30,000 people rely on ACA tax credits to afford health care. Without ACA tax credits, a Vermont family of four making $130,000 a year that currently pays $1,195 a month for a baseline health care plan can expect to pay $3,035 a month for that same plan—a $22,080 annual increase. A Vermont family of four making about $64,000 a year will pay 920% more.

Read and download the full text of the legislation here.

###