Health care, community hospitals, food assistance, jobs are on the line

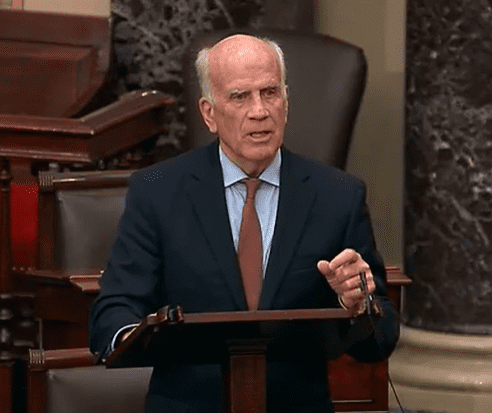

WASHINGTON, D.C. – Late last night, U.S. Senator Peter Welch (D-Vt.) took to the Senate floor to reveal how Republicans’ disastrous tax and spending bill will force millions of working Americans in Vermont, West Virginia, and across the country to lose their health coverage, rip away vital food assistance for more than 42 million Americans, cut clean energy incentives and add a tax to wind and solar energy, raise utility bills and grocery prices, and tank the economy—all to pay for tax cuts for the very wealthy.

“Never in my time in Congress have I seen a bill that does so much damage, in so many ways, to so many people, in so many states, and that will affect so many generations. The clerks have read the bill—it’s now time for us to kill the bill,” said Senator Welch. “I say let’s come to our senses and not do something that is a massive escalation of the wealth transfer from the working class, the middle class to the very, very wealthy. Many of us have a number of amendments—and I do too—to try to make the point that our job is to make things better for everyday working Americans, not inflict additional burdens on them.”

“We have a job to do, and it’s to strengthen this economy, provide more stability for our families and our communities. And in this bill, we’re doing exactly the opposite: aggravating income inequality, not mitigating it, accelerating climate change rather than diminishing it, making life tougher for everyday families. I urge my colleagues to defeat this bill.”

Senator Welch has proposed changes to Republicans’ One Big Beautiful Bill Act to prevent harm to rural hospitals, strengthen access to Medicaid and the Affordable Care Act, block cuts and policies that weaken the Supplemental Nutrition Assistance Program (SNAP) and other food assistance programs, protect home energy efficiency tax credits and the home efficiency workforce, and support federal public defenders.

Watch Senator Welch’s speech below:

Read key excerpts from Senator Welch’s remarks:

“Here’s the good, the bad, and the ugly. The good—we still have time to kill this bill, and we should kill this bill. We Democrats are united in opposition to this bill, but it’s not only Democrats whose constituents are going to be hurt by this bill. My colleagues on the other side of the aisle have an opportunity to make a choice. Read the bill and decide: are you going to protect your constituents—who are going to suffer the same afflictions as my constituents—or are you going to defer to President Trump?

“The bad in this bill—it’s going to inflict bipartisan pain. This is not aiming at red state or blue state. This is aimed at working class and middle-class Americans…More than 76,000 people in West Virginia will lose access to health care because of this bill. 278,000 West Virginians are going to lose access to the nutrition programs, to SNAP. In Tennessee, more than 295,000 people will lose access to health care and Medicaid through this bill. And SNAP means 758,000 Tennesseans lose the nutrition benefits.

“I want to repeat here: this is the bipartisan infliction of pain. This is real. This is real. And is the tax cut—largely directed to the very wealthy people—is it worth inflicting that kind of pain on so many, when the tax cut benefits so few?”

•••

“Inflation is going up under this bill. Just think how much more we’re going to pay in debt service—dead money. It’s about a trillion dollars. Home mortgages, folks are going to be paying at least a thousand dollars more. Small business loans, at least a thousand dollars more. Grocery prices, definitely going up for all Americans.

“There’s an ugly aspect of this bill as well, and it is that this bill is entirely in service of providing tax cuts, largely to the very wealthy. The top 1% of income earners in this country will get 60% of the benefit. That’s a couple hundred thousand people will get immense tax breaks that equal— exceed —the so-called ‘tax breaks’ that go to a couple of hundred million Americans. And it’s those in the 60% category paying the higher prices for utilities, credit card debt, cost of a car loan, rent, groceries.”

•••

Learn more about Senator Welch’s work by visiting his website or by following him on social media.

###